Are you considering a plastic surgery procedure and hoping that your insurance company will cover it? If so, there’s good news and bad news.

“It’s impossible to get a purely cosmetic procedure covered by insurance,” says Dr. Joseph Michaels, plastic surgeon with Michaels Aesthetic and Reconstructive Plastic Surgery in Bethesda, MD. That’s the bad news.

The good news is that procedures considered “medically necessary” may be covered even if they also serve to enhance your physical appearance. For example, breast reduction to treat your aching back or excess skin removal following dramatic weight loss are sometimes covered. It all comes down to your insurance carrier and plan.

The key to getting insurance coverage is to make a compelling argument for why that procedure is medically necessary, and how it can improve your quality of life.

In other words, you’re unlikely to get your health insurance to cover cosmetic surgery if your primary goal is to improve the way you look. However, there are many cases where that may be an added bonus.

What’s medically necessary?

Unfortunately, there’s no clear-cut answer to this question. Every company and insurance plan define “medically necessary” differently.

However, an important distinction is made by insurance providers between reconstructive surgery — which includes procedures such as breast reduction surgery and eyelid surgery — and purely cosmetic surgery.

Your insurance company may adhere to the following definitions supplied by the American Medical Association (AMA) in order to determine whether a procedure should be covered.

Reconstructive surgery: Reconstructive surgery refers to surgery performed on abnormal structures caused by congenital defects, developmental abnormalities, trauma, infection, tumors, or disease. This can include surgery to improve function or to give a normal appearance.

Reconstructive surgeries to correct birth defects and trauma are regularly paid for by insurance. For example, if you were born with ears that were deformed through the birthing process or disease, or should you have dramatically asymmetrical breasts, you may be able to use insurance to pay for cosmetic surgery.

Cosmetic surgery: Cosmetic surgery is the reshaping of normal structures on the body to improve the self-esteem or physical appearance of a patient. For instance, procedures such as laser resurfacing to smooth out your uneven facial complexion or a Brazilian butt lift to enhance your buttocks are very unlikely to be covered.

Impact on daily life

Some insurance companies or plans consider whether a particular condition has a negative impact on the patient’s daily lifestyle.

Is it a physical issue that interferes with their ability to attempt daily tasks, such as taking a shower or exercising, or is it more of an inconvenience, such as not being able to run a marathon? That’s the distinction that may ultimately need to be made.

For example, if a patient suffers from daily back and neck pain due to large breasts, which is a physical disability that can be addressed, breast reduction surgery may be considered medically necessary to alleviate the pain. If so, the cost would be covered by the insurance carrier rather than the patient.

If a condition inhibits “daily activities of living,” treatment required to eliminate or reduce such interference may be covered. This might be the case, for example, if a patient has excess skin from weight loss that hangs off the belly down to the knees. Such excess skin could get in the way of additional physical activity or even daily movement and could be considered medically necessary.

Photo documentation

“As part of a request for plastic surgery authorization, many insurance companies will want to see photographs of the patient to confirm the condition is as bad as the doctor is claiming it is,” says Michaels. Is the skin really impeding vision? Are the breasts really as heavy as stated?

It’s important to provide such photo documentation when making a case for coverage. “Photos are nearly essential today, as insurance companies are becoming more restrictive about approving procedures,” says Michaels.

Failure of conservative measures

Another important criteria that insurance companies now consider is whether other courses of treatment have already been tried. For example, has the patient been prescribed medication, have they had physical therapy, or other procedures?

If other potential treatment options have been tried without success, the insurance company needs to hear that surgery is not the first attempted solution, and that plastic surgery is the only treatment option left.

The best way to communicate that is to show “we tried all of these other alternatives and nothing worked,” says Michaels. This is also known as a “failure of conservative measures.”

Objective tests

As insurance companies and plans, like Medicare, are cracking down on coverage for procedures, new measures and tests are being enforced.

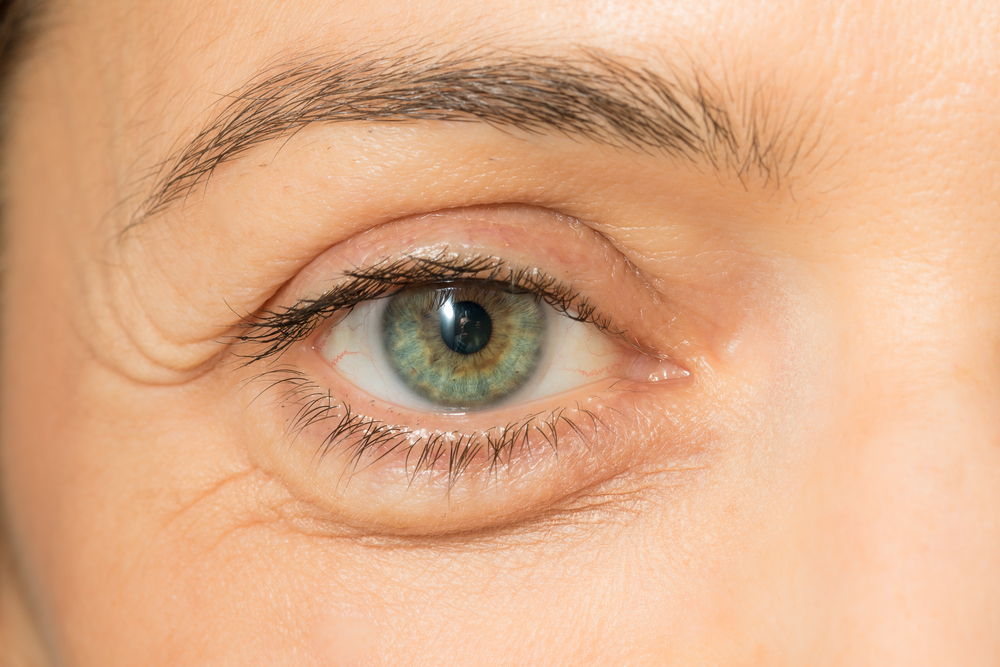

Instead of a doctor’s confirmation that, for example, eyelid skin is blocking a patient’s vision, a visual field test must be done and photographic documentation provided to demonstrate that the visual field is being blocked to a specific degree in order for the procedure to be approved for insurance coverage.

“The distance from the eyelid margin to the pupil, or the marginal reflex distance, must also be documented,” explains Dr. Brett Kotlus, a New York City-based cosmetic and oculofacial plastic surgeon, who performs upper blepharoplasty procedures regularly.

No more add-ons

“In the past, patients who required medically necessary upper eyelid surgeries could combine them with cosmetic upper eyelid procedures and pay out-of-pocket for the portion of the work deemed entirely cosmetic,” explains Kotlus.

For example, a patient might need an insurance-approved blepharoplasty and ask to also have some additional fat removal taken care of for cosmetic reasons, at their own expense. Having both surgeries done simultaneously is efficient and the cosmetic portion may therefore be less expensive than having it done on its own.

In certain cases, blepharoplasty is deemed medically necessary, and is covered by insurance, if the skin hanging over the eyelid is proven to interfere with vision. Photo credit: Dr. Brett Kotlus.

As of July 7, 2016, a new Medicare rule prohibits such add-ons of cosmetic upper eyelid procedures. “There have been abuses of this process, so regulations are becoming stricter, and many surgeons would say unfairly strict, or even illegal, by limiting patient autonomy” says Kotlus.

Recourse

According to Kotlus, it is possible to appeal the decision if a procedure is initially denied insurance coverage.

Doctors should also be aware that Medicare is now conducting more audits of procedures, requiring practices to prepare chart materials to justify or prove that a procedure met the criteria for being medically necessary. “Unfortunately, it puts a strain on the practice to have to devote resources to justifying procedures,” he says.

Nevertheless, Kotlus believes that it’s important for doctors to remain advocates for their patients when it comes to any kind of surgery, but the goal should not be to get insurance approval. It should be to provide as much information as is needed to get the appropriate coverage for the appropriate procedure.

Which cosmetic surgery procedures are usually covered?

Here are a few common procedures that are often covered by health insurance. It’s important to note that many other procedures, such as ear surgery and even teeth-straightening, may also be covered in certain circumstances.

- Breast reduction surgery

To qualify for reduction mammoplasty, the patient and her doctor must be able to show that large breasts have hindered her ability to perform certain physical activities, or that they have subjected her to physical pain — back and shoulder pain are the most common.

In order to address the physical symptoms associated with large breast size, surgery may be necessary. Just like all semi-cosmetic procedures, whether or not a reduction will be fully covered differs from company to company and plan to plan.

Breast reconstruction or a breast lift may be necessary for optimal results in addition to the reduction. In such scenarios, it’s common for the insurance company to pay for the reduction, but not the lift. Of course, when a patient has breast cancer, breast reduction or mastectomy surgeries are often medically necessary.

- Upper eyelid surgeries

As mentioned above, if drooping eyelids hinder a patient’s ability to see — and vision tests prove this to be the case — then blepharoplasty is often medically necessary. For this reason, eyelid surgery is one of the most common cosmetic procedures to be covered by insurance.

If the surgery is performed solely to help restore vision, then there’s a good chance it will be covered by insurance. However, patients may have the option to add a cosmetic component and pay for that portion out of pocket.

Many major insurance companies provide some coverage for weight loss procedures, including gastric bypasses. Proven methods such as gastric sleeves, lap gastric bands and gastric bypass are often covered, while experimental procedures are generally not.

People who are morbidly obese and have a high body mass index (BMI) as well as severe comorbidities (sleep apnea, heart disease, type 2 diabetes, cancer, and others) stand a good chance of getting weight loss procedures covered by insurance.

- Excess skin removal

Following dramatic weight loss, many people experience excess skin that can get in the way of physical activity and cause pain. Insurance may cover panniculectomy surgery or a tummy tuck in such cases.

However, this is not nearly as common as coverage for weight loss procedures, since most instances of droopy skin are still considered purely cosmetic. In rare cases — such as if you have a history of skin issues or are unable to exercise — insurance may cover the surgery in full.

- Rhinoplasty

Medical nose jobs, such as deviated septum surgery (also called septoplasty) are commonly covered by many health plans. However, aesthetic rhinoplasty is rarely covered.

If you can work with your ENT to make a case that having a reconstructive nose job will help improve your breathing, then there is a possibility that your insurance policy will take some of the burden. Just like with breast surgeries, many patients opt to have septoplasty coupled with a cosmetic rhinoplasty procedure at the same time. In such cases, insurance will likely cover the medically necessary septoplasty, while you pay the cosmetic portion out of pocket.

- Botox

You may know that Botox is now regularly used to treat migraines. In such instances, there’s a solid possibility that your insurance company will cover it, so long as you can show that your migraines have caused significant issues in your life.

However, it is important to note that complications that may occur as a result of such injections (for example, extreme swelling or infection) are often not covered.

- Gender reassignment surgery

Thanks to activists and lawmakers throughout the United States, some states now mandate that insurance cover gender reassignment surgeries. Insurance companies in California, Oregon, and Massachusetts are legally required to pay for such procedures, which may include mastectomies, reconstructive surgeries such as a vaginectomy or phalloplasty, and some body contouring procedures.

These procedures are an important factor in helping transgender people improve their self-esteem and feel more like themselves, which can lead to improved mental health. In most cases, the insurance company will require a letter of referral from a qualified mental health professional before they approve such surgeries.

Tips for getting covered

If you think you may be a candidate for insurance-funded cosmetic plastic surgery, a good surgery center will work with your medical insurance to help you make a solid case.

Make it clear to your doctor and the insurance company that you have tried other measures — such as weight loss, physical therapy, and pain treatment options — before resorting to surgery. This will help your insurance provider see the surgery as a “last resort,” which will make them more likely to cover it.

Medical documentation is also a very important part of the process. Make sure you keep records stating every health change you’ve made as well as all the times you visited your doctor in search of a solution.